David Bowie in finance: What were Bowie bonds?

Posted On

Posted On

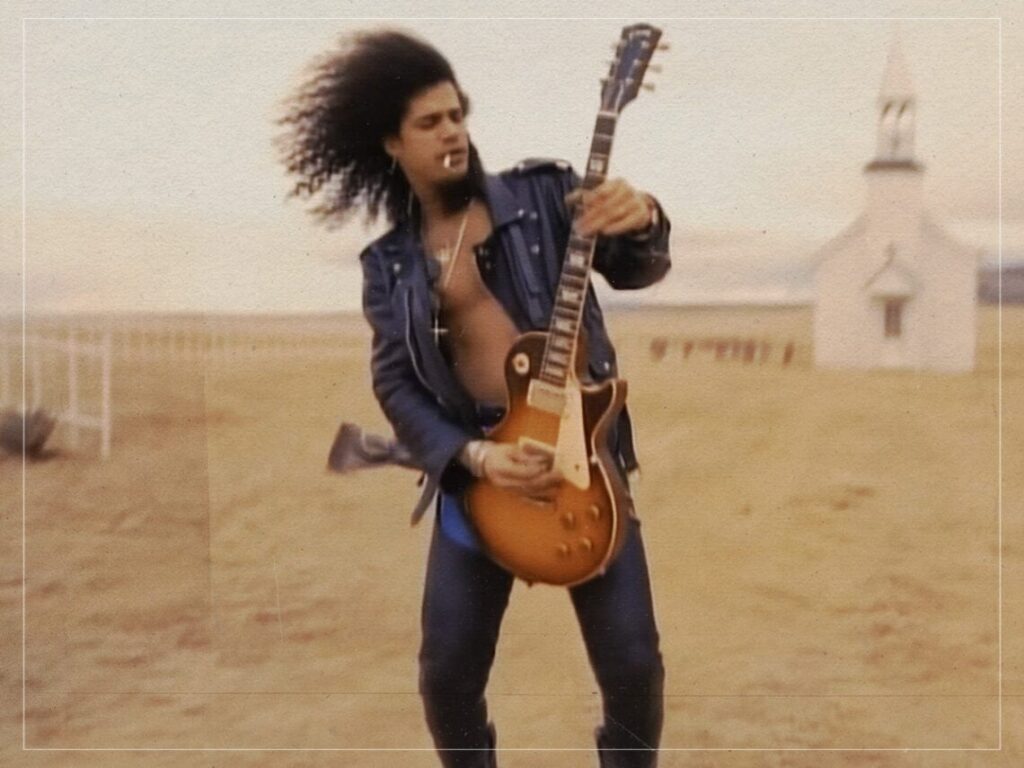

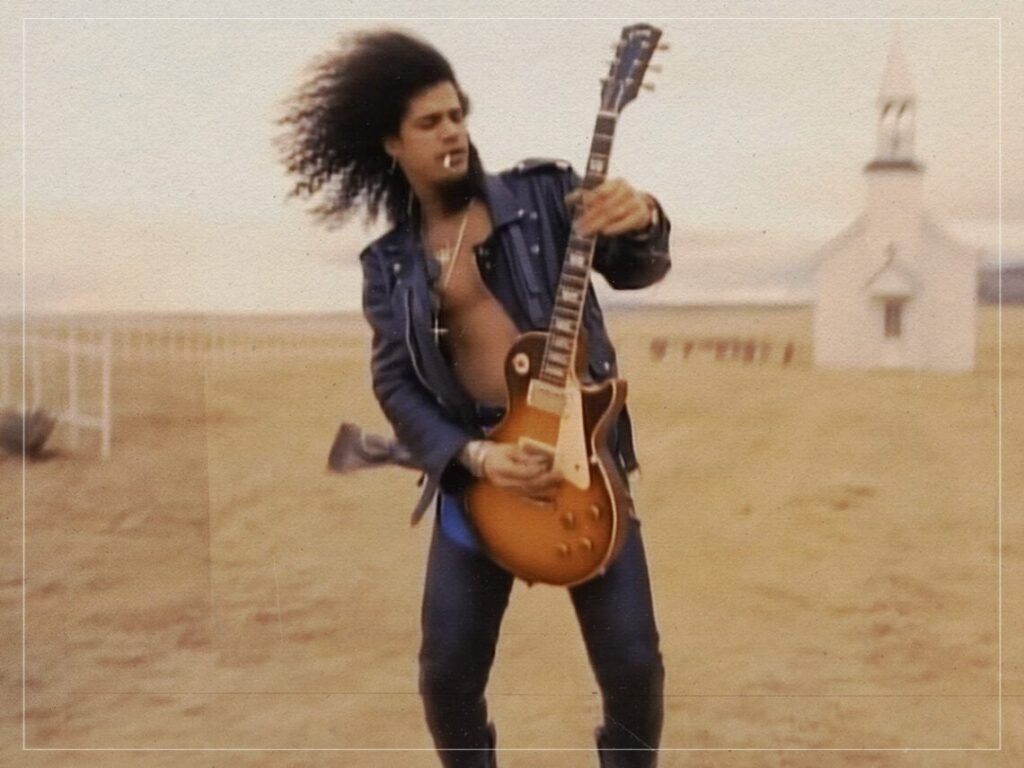

(Credits: Far Out / Alamy)

David Bowie‘s status as a musical and cultural innovator is indisputable, but not many know that in the 1990s, he also became a financial innovator, pioneering a new way for artists to control their income.

In 2024, artists’ revenue streams are closely tied to streaming services, but let’s go back to 1997 when the internet’s ubiquity was an almost unbelievable concept for many to grasp.

Working with investment banker David Pullman, Bowie came up with a new way to generate cash from his back catalogue, an endeavour so lucrative it later came to be copied by other artists seeking to take control of their royalty streams. What came to be known as Bowie bonds were asset-backed securities that gave investors a share of the artist’s future royalties for a decade. As detailed by the Financial Times, Bowie received a payment of $55million from Prudential Financial, an insurance company, with an interest rate of 7.9%.

This was achieved through a deal with EMI, which allowed Bowie to sell bonds backed by the future royalties made from the 25 albums Bowie recorded before 1990, including classics like The Man Who Sold The World and The Rise and Fall of Ziggy Stardust and the Spiders From Mars. The artist used part of the money to buy rights to much of his 1970s catalogue, which was, at the time, owned by his former manager Tony DeFries. This would then, in turn, generate more royalties to bondholders.

Following the success of Bowie bonds, Pullman went on to create similar bonds, helping securitise intellectual property rights for artists like James Brown, the Isley Brothers and Holland-Dozier-Holland publishing catalogue (which includes countless hits recorded by Motown artists like the Supremes).

Bowie’s savvy financial move paid off; his estate was estimated to be worth between $100million and $230m when he died in 2016.

It’s important to remember Bowie was one of the first high-profile artists to embrace the power of the internet, recognising its potential to revolutionise the way musicians share and sell their music, and how they interact with their audiences. In 1998, he launched BowieNet, his own internet service provider and online fan club, where he interacted with fans. A year later, he released Hours…, the first album to go on sale digitally before it hit record shops – which at the time caused an uproar in the music industry.

David Bowie predicted the rise of the internet

In an often-shared interview with Jeremy Paxman held that same year, Bowie predicted the impact the internet would have on the music industry, and the world as a whole. “I don’t think we’ve even seen the tip of the iceberg, I think the potential of what the internet is going to do to society, both good and bad, is unimaginable,” he told Paxman, who dismissed the internet as simply ‘a tool’.

“I think we’re actually on the cusp of something exhilarating and terrifying,” he said. “The actual context and the state of content is going to be different to anything that we can really envisage at the moment, where the interplay between the user and the provider will be so in simpatico it’s going to crush our ideas of what mediums are all about”.

But his foresight extended far beyond that, telling the New York Times in 2002 that music as a commodity would eventually become “like running water or electricity”. Much of his prophecy has come true, as the value of Bowie bonds began to decline as album sales plummeted with the rise of online streaming. Instead of selling bonds, musicians today earn money through per-stream payouts, which has made making money all the more challenging, especially for newer acts.

But as Bowie said, the internet has opened up new, unimaginable possibilities for artists to make money. Crowdfunding became a new medium, allowing artists to create while directly supported by their fans. An example is Amanda Palmer, who famously raised $1.2m on Kickstarter to fund her second album Theatre Is Evil in 2012 and went on to successfully crowdfund several albums and projects.

Although Bowie bonds are less common today, their legacy is a testament to Bowie’s innovative spirit, which helped many legendary artists like himself secure their future before the music industry changed for good. His approach is a reminder that as the music industry adapts, so must the methods by which artists fund their creativity.

[embedded content]

Related Topics